Additionally, no-document loans can be helpful for these with good credit score however restricted documentation. This can include individuals who're in transition, corresponding to shifting between jobs or starting a model new enterprise, and may not have concrete income information availa

Benefits of 24-Hour Loans

One of the primary advantages of a 24-hour Loan for Low Credit is its velocity. In emergency conditions, accessing funds rapidly can be essential. Whether it’s an surprising medical emergency or an urgent car repair, a 24-hour mortgage allows individuals to cover their expenses direc

Having a checking account is also a standard requirement, as funds are normally deposited directly. Lenders could undertake a gentle credit verify, but many nonetheless offer loans to individuals with less-than-perfect credit score histories. However, demonstrating a reliable income can significantly improve the possibilities of appro

With a user-friendly interface, 베픽 makes it easy for potential borrowers to navigate through mortgage provides, understand terms, and make knowledgeable decisions. The web site additionally offers academic content material that helps users grasp the intricacies of borrowing and responsible management of lo

Another appreciable benefit is the speed at which these loans may be disbursed. Many lenders present immediate or same-day funding, enabling debtors to address pressing financial needs with out prolonged wait instances. This swift response can be instrumental in situations where timely motion is critical, similar to repairing important instruments or paying for transportation pri

Additionally, the lack of rigorous monetary assessment can lead to a scenario where debtors overextend themselves. By not completely evaluating their monetary capabilities through documentation, some may find themselves in financially precarious conditions when compensation comes

Understanding Interest Rates

Interest charges on student loans can significantly influence the entire price of borrowing. Federal Student Loan mortgage rates are sometimes fixed and set annually, making them predictable compared to personal Other Loans, which may characteristic variable interest rates that can fluctuate over t

Additionally, the appliance course of for these loans is usually straightforward and might sometimes be completed on-line. Many lenders do not require intensive documentation, making it accessible for people who might not have conventional credit score history. This simplicity attracts many debtors who need funds shortly with out going through the prolonged approval processes of traditional lo

Lastly, some individuals consider that these loans are unsuitable for any critical financial want. However, when managed responsibly, Day Laborer Loans can function an efficient tool for tackling instant monetary challenges or investing in one’s day labor activit

Understanding the terms and conditions related to Day Laborer Loans is essential for debtors. One wants to listen to the reimbursement timeline, rates of interest, and any additional fees that may apply. This consciousness helps people keep away from falling into a cycle of debt, which is a common challenge for those with limited financial opti

It's additionally worthwhile to ask about reimbursement options! Many lenders allow flexibility when it comes to fee schedules, which might significantly influence a day laborer's capability to pay again the mortgage with out str

Criteria for Obtaining a 24-Hour Loan

To qualify for a 24-hour loan, people sometimes want to satisfy sure criteria. Most lenders will require applicants to be at least 18 years old and possess valid identification. Additionally, proof of earnings is commonly required to discover out the borrower’s ability to repay the l

The Role of BePick in Borrowing Decisions

BePick serves as a useful useful resource for these considering 24-hour loans by offering extensive details about various lenders and loan products. The website provides reviews that assist consumers understand the pros and cons of various choices, making it simpler to navigate the borrowing panor

Additionally, the quick turnaround of these loans can sometimes lead to impulsive borrowing. In the push to secure funds, people might overlook essential details or choose to not assess whether they can manage compensation adequately. Understanding the long-term implications of borrowing is criti

For these thinking about Day Laborer Loans, 베픽 serves as an invaluable useful resource. This platform offers complete information about various loan options obtainable to day laborers. Users can find detailed critiques, comparisons of different lenders, and insights into the newest market developments regarding day labor financ

For federal loans, interest rates are sometimes decrease than these of private loans. However, it is essential for college students to notice that while federal loans supply benefits like income-driven reimbursement plans, private loans might have fewer safeguards. Understanding the interplay between rates of interest and reimbursement terms is important to minimizing complete debt bur

搜索

热门帖子

-

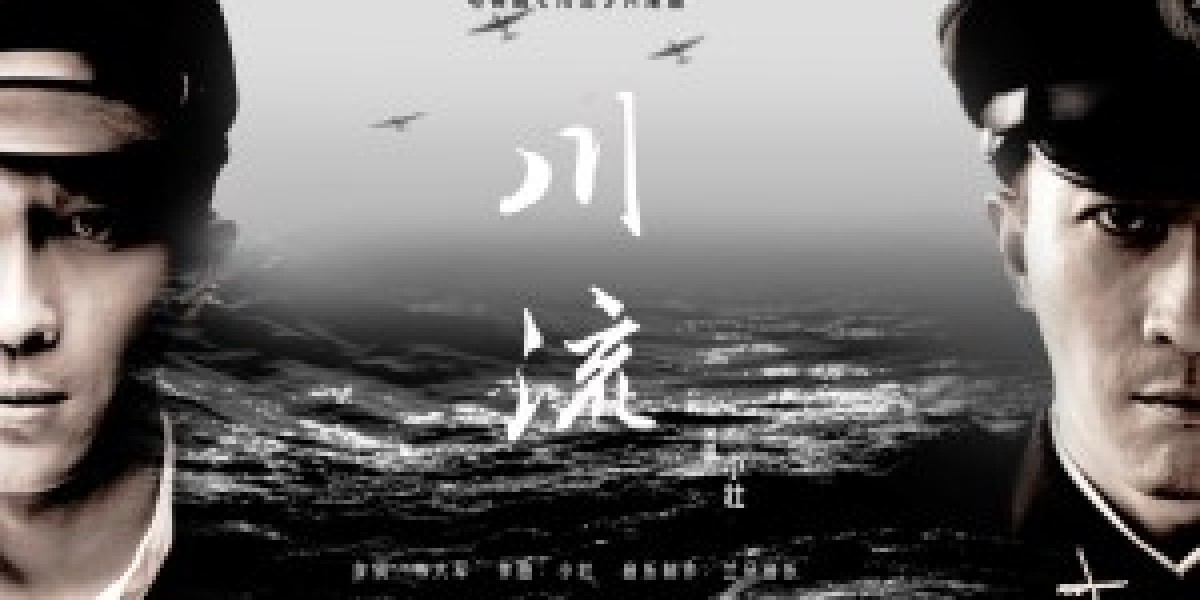

《无主之花》:爱恨交织的古装情感史诗

经过 chenchen123

《无主之花》:爱恨交织的古装情感史诗

经过 chenchen123 -

Fixit pain relief cream – fixit cream & gel review – Why fixit is India's top choice for pain relief?

Fixit pain relief cream – fixit cream & gel review – Why fixit is India's top choice for pain relief?

-

Renew MetaBolic Regeneration Formula Review – Natural Weight Loss Capsule

Renew MetaBolic Regeneration Formula Review – Natural Weight Loss Capsule

-

Escort Services in Hong Kong: A Glimpse into the Industry

经过 Lau Kaki

Escort Services in Hong Kong: A Glimpse into the Industry

经过 Lau Kaki -

Gluco6: Blood Sugar Capsule (Customer Reviews and Complaints)

经过 gluco6

Gluco6: Blood Sugar Capsule (Customer Reviews and Complaints)

经过 gluco6